how to determine unemployment tax refund

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive.

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

The letters go out within 30 days of a correction.

. The IRS said the next round of refunds would come out in mid-June. Unemployment Compensation Subject to Income Tax and Withholding. Go to the Employees menu then Payroll Taxes and Liabilities and select Adjust Payroll Liabilities.

This free tax calculator helps you see how. Cancel Continue how to calculate unemployment tax refund. Use the same date as the last paycheck of the affected quarter.

To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. Dont include any amount of unemployment compensation from Schedule 1 line 7 on this line. The number is in Box 1 on the tax form.

Using the IRS tool Wheres My Refund go to the Get Refund Status page enter your personal data then press Submit. This handy online tax refund. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. The first refunds are expected to be made in May and will continue into the summer. How to calculate unemployment refund check amount Internal Revenue Servicehttpswwwirsgovcredits-deductionsadvance-child-tax-credit-eligibility-assis.

File with a tax pro File online. For those taxpayers who already have filed and figured their tax based on the full amount of unemployment compensation the IRS will determine the correct taxable amount of. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

The amount of 10200 is the income exclusion amount for single tax filers do not the amount of the reimbursement. If you entered your information correctly youll be taken to a. The tax break is for those who earned less than 150000 in adjusted gross income.

Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income. The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their withholding consider. The amount of reimbursement will vary per.

Every employer in Tennessee is required to fill out a Report to Determine Status Application for Employer Number LB-0441. Quickly estimate your tax refund with TaxCaster. Answer If you repaid the overpayment of unemployment benefits in the same year you received them Subtract the amount of.

Use the line 8 instructions to determine the amount to include on Schedule 1 line 8 and enter. Submitting this form will. Find information on Reporting Unemployment Benefits to the IRS this includes information regarding Form 1099G.

The IRS has sent 87 million unemployment compensation refunds so far. This is available under View Tax Records then click the Get Transcript button and. Choose the federal tax.

This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return. Another way is to check your tax transcript if you have an online account with the IRS. File Wage Reports Pay Your Unemployment Taxes Online.

There is no tool to track it but you can check your tax transcript with your online account through the IRS. Heres what you need to know.

Irs Tax Refunds To Start In May For 10 200 Unemployment Tax Break Brinker Simpson

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

What You Should Know About Unemployment Tax Refund

Stimulus Check Update Irs Says It Will Automatically Adjust Tax Returns For Unemployed People Nj Com

3 12 154 Unemployment Tax Returns Internal Revenue Service

430 000 More Taxpayers Get Unemployment Related Tax Refunds Don T Mess With Taxes

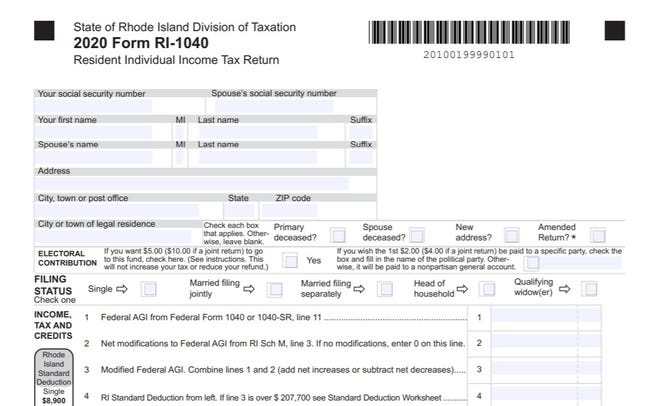

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Unemployment Tax Refund From The Irs Could Mean Thousands Back In Your Pocket

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Unemployment Tax Refund Don T Waste Your Money Again

Unemployement Benefits Are This Payments Taxable Marca

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Irs Unemployment Tax Refunds 4 Million More Going Out This Week King5 Com

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

Paystubsnow On Twitter Unemployment Tax Refund An Unemployment Tax Refund Is A Great Way To Get Money Back On Taxes That You Ve Already Paid Want To Know How Can You Find Out